Estimated reading time: 3 minute(s)

This weekend, as I was pumping fuel into our family’s minivan, I had an idea.

This weekend, as I was pumping fuel into our family’s minivan, I had an idea.

I know that our economy is not great. (In fact, I realize that there’s absolutely no way we can actually “recover” from our debt without a seriously radical change in thinking regarding cashflow, in and out… but that’s a different story entirely.) People all across our nation are concerned about their jobs (or lack of jobs), concerned about higher costs, and the ever-present uncertainty of things like the stock market and other financial fixtures.

Well I had an idea that would most assuredly boost our entire economy. And though, as I mentioned, it wouldn’t eliminate the iunsurmoutable debt we have accumulated—and continue to add to—it would provide, in my estimation, a considerable “boost.”

Without delay, federal and all state fuel taxes (gasoline and diesel) should be completely eliminated. Period.

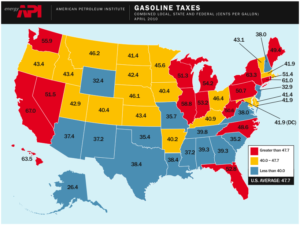

According to the American Petroleum Institute (API), in April 2010, the Federal tax on gasoline is $0.184/per gallon, and State taxes then range from ~8¢/gallon to around 49¢/gallon!. (My state, New York, comes in at a whopping 44.9¢/gallon (on TOP of the Federal tax).

Rather than continuing to tax US citizens, to generate funds that likely could come from other sources, why not allow the economy to thrive by reducing the cost of the “fuel” that runs it. (Pun intended, of course.)

If gas prices were reduced in NY by $0.63/gallon, that would be a savings of roughly $15.00 per tank of gas for our vehicle. $15 per tank full. So, $15 per week, sometimes more. Let’s say we fill up slightly more than once per week, that’s about $900/year that we are getting back, just for our family.

Now, think about how the reduced fuel cost will affect every other part of our economy.

First, consumers have more money to invest in the economy. Buying more things that they need. That’s good. AND, the governments (at least state governments) will make some of the lost fuel tax revenue back from the increased sales tax revenue, right?

Then, added to that, would be the lower cost of goods. The main way we get stuff to where it needs to go—and to the consumers—in our country is the trucking industry. If the cost of fuel was dramatically reduced by eliminating tax, it would have a “ripple” effect on the prices of every other good that was being transported. Food prices would go down, clothing, and whatever other materials are being shipped, and this would allow for more commerce: more buying.

Travel prices would go down, allowing more people to spend their saved money in the travel industries. Companies who use shipping companies to move their products would be able to invest their savings from fuel costs into other areas, which might include providing more jobs.

I can not see how this is not an absolute “win” for everyone involved. Can you? What am I missing here? As I said, there are plenty of other sources of funding that governments could pull from, and some of those would likely be increased by the true “stimulus package” of eliminating this one tax.

Really, this needs to be done in so many areas, but I think if our governments would take this first step, it would be a huge step toward a stronger, healthier American economy.

NO WAY bigger government, more taxses and while we are at it why don’t we just take down any monuments to those pesky forefathers?!?

just my two cents! 🙂

keep thinking in that head, and send it on to the men in charge while you are at it, you never know.

I figure this is “starting small”. There are so many taxes (and government offices and programs along with them) that need to be eliminated, but this would make a very noticeable, tangible difference. For everyone. I think. 🙂 I was thinking I would forward a link from this to relevant government officials … we’ll see what happens.